Estate Planning FAQs

What Is An Estate Plan?

An estate plan is the process of deciding what will happened to your family and your “stuff” after you die. If you have minor children you can plan to provide for them financially and most importantly you can plan for their care if you are not around. You can also plan for what happens to all of your assets (your home, your car, your investments, your insurance). You can work on reducing your possible estate taxes.

An estate plan can also address situations that occur during your life, such as if you become disabled or incapacitated either temporarily or permanently. You can decide ahead of time who will be responsible for making your health care and financial decisions.

Why Should I Do an Estate Plan?

1) Ensure smooth transition for your loved ones.

2) Make sure your spouse and children are taken care of.

3) Avoid or minimize probate.

4) Make sure you have the right people making decisions for you.

5) Minimize taxes where possible.

6) Avoid family conflicts.

7) Stay out of the court system.

8) Control your own assets.

What Happens If I Don't Do an Estate Plan?

You are giving up your right to:

1) Decide who will make decisions for your health care should you become incapacitated or disabled.

2) Decide who will make financial decision for you should you become incapacitated or disabled.

3) Decide who will take care of your children if you are incapacitated, disabled or die.

4) Decide how the money will be used for your children.

5) Decide how your property and money will be distributed to others.

6) Institute a plan to avoid excessive estate taxes.

7) Decide if you want life sustaining treatments or not.

Here is an example of an individual who dies in the state of Illinois without any estate planning.

I, John Doe, have not made an estate plan, therefore I will let the laws of the State of Illinois decide on my behalf.

I will give my loving wife ½ (half) of my assets and the other ½ (half) shall go to my children equally.

I appoint my wife as guardian of our children, but I will require her to report to the Probate Court on a yearly basis to render an accounting of how she is handling her children’s money.

I shall further require my wife to produce a Performance Bond to the Probate Court to guarantee that she uses proper judgment in handling her children’s money.

Further, I shall also allow my children the right to demand a complete accounting from my wife, their mother, of all her financial actions with their money as soon as they are adults.

When our children do reach the age of 18 they shall have full rights to their money and may withdraw and spend it as they wish.

Should my wife remarry and also die without a will, her second husband shall be entitled to ½ (one half) of everything in my wife’s name.

Should our children need some of this money the second husband not be required to share it with our children.

The second husband shall have sole right to decide who is to get his share and may exclude our children.

If my wife dies before I do while any of our children are minors, I do not wish to exercise my right to nominate the guardian of my children and instead direct my relatives and friends to get together and select a guardian by mutual agreement. If they fail to agree on a guardian, I will let the Probate Court make the selection. If the court wishes, it may appoint a stranger instead of a friend or family member.

Since I prefer to have my money used for governmental purposes rather than for the benefit of my wife and children, I direct that no effort be made to lower taxes.

Excerpted from “Estate Planning Quick Guide 2007.”

Estate Plans For Loved Ones

You can avoid the stress of an unplanned estate and avoid wasted money on probate by doing proper estate planning. Everyone needs an estate plan whether you are young or aged, married or single, with or without children. AMC Legal can help educate you on the process and on what is best for your unique situation.

I offer a free initial consultation to go over any questions you may have and to discuss your individual needs. I also offer a free review of your current estate plan if you have one. We can discuss any changes that may need to be done to bring the documents up to date if necessary.

What Is A Probate?

Death related probate is a court process that takes place after a person is dead. In that process the court will: validate a will (if any), appoint a personal representative, gather all assets, pay all debts, expenses and taxes, and finally distribute what’s left to the heirs.

To determine if your assets may be subject to probate you need to look at all of your assets combined, then you can remove property that you own in joint tenancy with right of survivorship or as tenants by the entirety, then you can remove assets which have a beneficiary designation such as life insurance, and pay on death accounts, what’s left will be close to your probate estate. If the remaining assets are under $100,000 for an Illinois resident you could file a small estate affidavit and short cut the probate estate. Otherwise your estate will most likely be subjected to the probate process.

Keep in mind, even if you own property as joint tenants with your spouse, what happens if you both pass simultaneously? Are all of your account beneficiaries properly set up? What happens if these become out dated and I pass away without correcting it? A will and a trust would take care of these issues.

What Do I Need?

I would recommend at least the following documents for each individual:

1) Will

2) Power of Attorney for Health Care

3) Power of Attorney for Property

I would highly recommend have a Living Revocable Trust as well. A Living Will is also an option but that depends on the wishes of each individual.

What Is A Will?

This is document you can create during your life which directs the manner you’d like your property to be distributed after you die. You can also name guardians for your minor children. You can change it at any time during life (if done in the proper manner). However, it will NOT avoid probate proceedings unless your estate is worth less than $100,000.

What Is A Healthcare Power Of Attorney?

A Power of Attorney for Health Care is a document in which you can establish who will be responsible for making health care decisions if you were unable to make these decisions on your own either temporarily or permanently. The Power of Attorney gives legal authority to another person to make those decisions on your behalf should you be unable to in the case of a disability or incapacity. You can also make elections as to how you’d like to handle life support, make anatomical gifts and your wishes for being laid to rest.

What Is A Property Power Of Attorney?

A Power of Attorney for Property is a document in which you can establish who will be responsible for handling your assets (money and property) if you were unable to make these decisions on your own either temporarily or permanently. The Power of Attorney gives legal authority to another person to make those decisions on your behalf should you be unable to in the case of a disability or incapacity.

What Is A Durable Power Of Attorney?

A Power of Attorney, either for health care or for property, is durable if it it allows a person to make decisions for the Principal (maker of the power of attorney) when they are incapacitated and unable to make decisions. All powers of attorney in Illinois are automatically Durable unless specified otherwise. A non-durable power of attorney is done usually outside of estate planning needs such as if you need to appoint someone for a particular purpose like a real estate closing or other short term, one time needs.

What Is A Living Will?

A Living Will is a document that will speak directly to your health care providers for you if you are unable to speak for yourself. It will direct the health care providers how you want to handle life support and death delaying treatments. This is different from a Health Care POA because it takes the decision out of anyone else’s hands. You choose ahead of time how you want to be treated and the doctors will be bound by those decisions. There are pros and cons to this document. Once you are in that situation, no one can waiver from what the document directs. However, it does take the difficult decision out of the hands of a loved one. It if often referred to as a DNR or Do Not Resuscitate Order.

What Is A Trust?

If the trust is created while you are alive then it is called a Living Trust. If the trust allows you to change it or cancel it then it is a Living Revocable Trust (legal term is Inter Vivos Trust). If you cannot change or cancel it then it is called an Irrevocable Living Trust.

Essentially you create a Pour Over Will and a Living Revocable Trust and you then title all of your property (house, bank accounts, investments etc.) in the name of the trust. You, as Trustee (creator) of the trust can still buy, sell, mortgage and control all of the property while you are alive. But when you die (or both spouses die if a marital trust) then no more changes can be made to the trust. The property is then distributed according to the trust. Any property you don’t have in the trust at your death is either distributed by beneficiary designations on those accounts or passes into the trust by a Pour Over Will. Imagine all assets outside the trust are put into a bucket and that bucket is poured into the Trust so it can be distributed with everything else.

All assets inside the trust (or later added by the pour over will) do not need to go through probate. The trustee that you set up to take care of everything after your death can pay all funeral expenses, final bills, death taxes and file your final tax return without having to go through probate, without having to pay a bond or fees and without delay. Then after final bills are settled your heirs (the people you are leaving your assets to) can get the assets much quicker than if you had to go through probate.

The trust is a document that is created at your direction, signed and stored with all your estate planning documents. It does not need to be recorded publicly with any office, so it remains private.

Furthermore, if you have minor children or are leaving property to minor children then you can provide for the delay in inheritance to these minors until they become adults. It is very flexible and you can create a good plan for providing for their education, living expenses and health until they reach an adult age.

Can I Do It Myself?

The question is not can you but should you. Often times forms you can find on the internet or in a book store are not going to be suitable to each and every individual. They also may not have the appropriate tax clauses, they may not be up to date on the current law (which changes about every 2 years in recent times) and they may not be tailored to Illinois laws.

In certain situations it is definitely worth at least speaking to an experienced attorney. For instance if you have minor children, if you have a special needs child, if you are divorced or have children from outside your current marriage, if you have tax concerns, if you want to avoid probate and if you have property out of the state. This list is not all inclusive. If you use a pre-made estate plan you may not be getting what you actually need because there is no one to speak to. There is no one size fits all solution for estate planning.

Please feel free to call me. I give free consultations both in person and on the phone. I will review your current estate plan for free. And my fees are very reasonable, often times my fees are comparable to many other online services, but you are getting an experienced attorney to custom tailor a plan for your family’s needs.

Can I Accomplish the Same Thing Without A Will/Trust?

The most basic estate plan document is a will. Each person needs one in order to direct how they want things handled after they are gone. There are ways around using a trust, but it can be risky. It is much easier and much safer to do a trust and to fund it properly.

There are ways to avoid probate without a living revocable trust. One way is to do a transfer on death instrument (TODI) for your house. This is a way to leave your home to someone once you’ve died without having to go through probate. Certain checking or savings accounts, investments accounts and the like can be left to someone without going through probate by designating the proper beneficiaries on each account. Life insurance usually passes outside the trust and goes directly to the listed beneficiary as well.

However, a person needs to be very careful if following this plan being sure and double checking how each beneficiary is set up on each and every account. For instance, if an individual dies with a living revocable trust and a pour over will, then if an account doesn’t have a beneficiary listed, the pour over will would dump it into the trust and it would pass with the rest of their estate.

If you do not have a trust and an account is not set up with a beneficiary, if the beneficiary has passed or refuses the gift (which can happen if there are certain tax consequences) then probate proceeding may be necessary.

A Trust can also deal with minor children, especially if a secondary beneficiary is a minor (for instance you leave your property to your child and if he/she dies before you do then to their children). A trust can also list many back up beneficiaries in case your first choice has passed before you or refuses a gift. A trust doesn’t have any maintenance fees while you are alive such as a Land Trust would.

For a full discussion on which plan would better suit your needs please give me a call.

What on Earth is Per Stirpes and Per Capita Anyway?

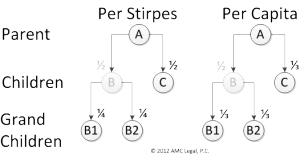

There are two ways to distribute your assets among your descendents (children and grandchildren). One is per stirpes and the other is per capita. For instance, say you leave your 2 children (B and C) all of your estate to share equally.

So each child will get 50% of the estate. Child A gets 50% of your estate and Child B gets 50% of your estate.

Say you also provide that if one of your children dies before you do, then your grandchildren would split that child’s inheritance. Let’s also say that Child A dies before you do leaving 2 children (your 2 grandchildren B1 and B2). Therefore, Child C would still get 50% of your estate, Child B cannot inherit since they predeceased you, but Child B’s 2 children (B1 and B2) will split Child B’s 50% of your estate so they would then each get 25% (or half of child B’s inheritance).

The other way to inherit is Per Capita. Say the same instance above but you leave it to the children Per Capita. In that instance Child C would share all of the inheritance with Child B’s 2 children (B1 and B2). Child C would receive 33.3%, Grandchild B1 would receive 33.3% and Grandchild B2 would receive 33.3%.

Most people think it’s more fair for their own children to get the original share and for the grandchildren to share their parent’s share. That would be Per Stirpes.